Audit and Assurance

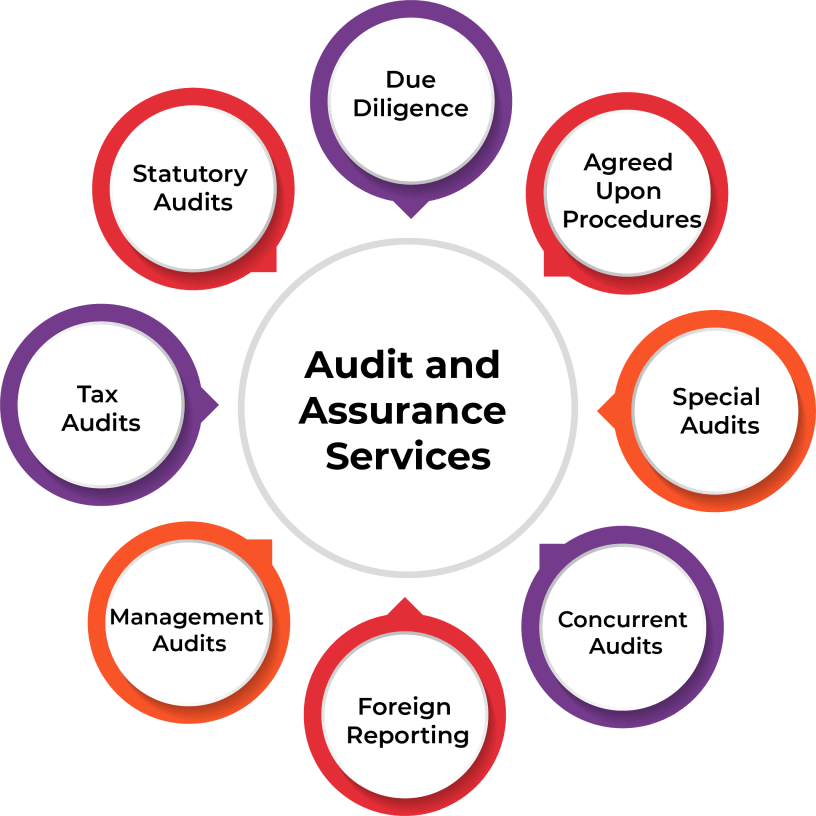

When running a business, it is essential to maintain accurate financial records and stay on top of the paperwork so you can continue to successfully grow your business. A simple and accurate audit depends on your business having kept up accurate book keeping. One of the best reasons for auditing financial statement is to future proof yourself. In the long term, and Audit protects your hard work and investment. Audit and other forms of assurance report provide levels of comfort not only to current and prospective shareholders, but also to management, boards, trustees, regulators and others stake holders. In India there are audits which are mandatory. Our team has right mix of a skills and competencies to full fill their roles properly in order to provide best and quality Audit and Assurance services to the clients. We ensure that entire auditing and assurance service is effortless to the extent possible so that they can reap its benefits